| Nombre | Industria | Compartir, % | P/BV | P/S | P/E | EV/Ebitda | Rendimiento de dividendos |

|---|---|---|---|---|---|---|---|

Tencent Holdings Limited Tencent Holdings Limited |

Communication Services | 2.41163 | 2.7 | 4.27 | 22.55 | 10.34 | 1.61 |

| SharkNinja, Inc. | Consumer Cyclical | 2.21367 | 4.77 | 1.66 | 42.26 | 13.9 | 0 |

Carnival Carnival |

Consumer Discretionary | 2.21351 | 3.81 | 1.41 | 18.38 | 10.1 | 0 |

BOC Hong Kong (Holdings) Limited BOC Hong Kong (Holdings) Limited |

Financials | 2.10339 | 0.6718 | 3.12 | 6.37 | 0 | 6.39 |

AT&T AT&T |

Telecom | 1.95112 | 1.01 | 0.9811 | 8.34 | 5.77 | 5.49 |

| Bridger Aerospace Group Holdings, Inc. | Industrials | 1.94362 | 6.13 | 2.48 | 21.42 | -8.21 | 0 |

NICE Ltd. NICE Ltd. |

Technology | 1.90457 | 3.96 | 5.59 | 39.31 | 22 | 0 |

GlaxoSmithKline GlaxoSmithKline |

Healthcare | 1.89231 | 9.36 | 3.95 | 24.31 | 14.52 | 3.93 |

Inner Mongolia Yili Industrial Group Co., Ltd. Inner Mongolia Yili Industrial Group Co., Ltd. |

Consumer Staples | 1.78078 | 2.9 | 1.32 | 15.93 | 12.85 | 0 |

| Concentra Group Holdings Parent, Inc. | Healthcare | 1.62594 | 8.43 | 1.33 | 15.12 | 7.65 | 0 |

NetEase, Inc. NetEase, Inc. |

Communication Services | 1.54612 | 2.8 | 3.46 | 12.18 | 16.36 | 3.34 |

Pinduoduo Inc. Pinduoduo Inc. |

High Tech | 1.45998 | 8.09 | 6.12 | 25.23 | 19.85 | 0 |

Beijing Enterprises Holdings Limited Beijing Enterprises Holdings Limited |

Industrials | 1.38586 | 0.2888 | 0.359 | 5.37 | 4.74 | 6.22 |

China Gas Holdings Limited China Gas Holdings Limited |

Utilities | 1.36421 | 0.6523 | 0.4867 | 12.44 | 10.66 | 6.92 |

| agilon health, inc. | Healthcare | 1.32814 | 7.75 | 1.19 | 0 | -23.88 | 0 |

WH Group Limited WH Group Limited |

Consumer Discretionary | 1.24102 | 0.7734 | 0.3118 | 13 | 19.35 | 7.93 |

| China Feihe Limited | Consumer Staples | 1.20438 | 1.29 | 1.75 | 10.06 | 2.93 | 11.12 |

| Kao Corporation | Financials | 1.19495 | 2.67 | 1.76 | 61.61 | 14.58 | 3.52 |

Z Holdings Corporation Z Holdings Corporation |

Consumer Cyclical | 1.19461 | 0.8546 | 1.62 | 26.02 | 8.91 | 2.86 |

Alibaba Group Holding Limited Alibaba Group Holding Limited |

Consumer Cyclical | 1.19169 | 1.13 | 1.34 | 15.78 | 10.28 | 2.59 |

STMicroelectronics N.V. STMicroelectronics N.V. |

Technology | 1.1625 | 2.81 | 2.74 | 11.24 | 7.22 | 1.05 |

| ESR Group Limited | Real Estate | 1.15539 | 0.6544 | 6.56 | 24.75 | 70.06 | 3.27 |

Banco Santander, S.A. Banco Santander, S.A. |

Financials | 1.13292 | 0.0414 | 1.03 | 5.54 | 2.11 | 3.77 |

Rogers Corporation Rogers Corporation |

Technology | 1.11761 | 2.03 | 2.82 | 45.18 | 20.76 | 0 |

S.F. Holding Co., Ltd. S.F. Holding Co., Ltd. |

High Tech | 0.99547 | 2.57 | 0.85 | 32.67 | 17.85 | 0.54 |

China Merchants Bank Co., Ltd. China Merchants Bank Co., Ltd. |

Financials | 0.99424 | 0.6395 | 2.06 | 4.74 | 0 | 0 |

JD.com, Inc. JD.com, Inc. |

Consumer Cyclical | 0.98227 | 1.02 | 0.28 | 12.57 | 7.55 | 5.47 |

Swire Properties Limited Swire Properties Limited |

Real Estate | 0.93799 | 0.3985 | 8.34 | 14.44 | 12.24 | 8.96 |

| Hitachi Construction Machinery Co., Ltd. | Industrials | 0.92053 | 1.19 | 0.6887 | 10.38 | 6 | 5.31 |

Enerplus Corporation Enerplus Corporation |

Energy | 0.90905 | 2.75 | 1.99 | 7.4 | 3.66 | 1.69 |

ANTA Sports Products Limited ANTA Sports Products Limited |

Consumer Cyclical | 0.90237 | 3.42 | 3.07 | 18.69 | 13.15 | 2.9 |

| NexImmune, Inc. | Healthcare | 0.87917 | 0.6519 | 0 | 0 | 0.03 | 0 |

| Nisshinbo Holdings Inc. | Industrials | 0.82777 | 0.6294 | 0.3519 | 8.06 | 39.92 | 5.47 |

Wuliangye Yibin Co.,Ltd. Wuliangye Yibin Co.,Ltd. |

Consumer Staples | 0.82405 | 5.02 | 8.18 | 22.34 | 13.54 | 2.25 |

Sinopharm Group Co. Ltd. Sinopharm Group Co. Ltd. |

Healthcare | 0.77367 | 0.4526 | 0.0913 | 6.01 | 2.69 | 5.18 |

Shenzhou International Group Holdings Limited Shenzhou International Group Holdings Limited |

Consumer Cyclical | 0.76129 | 3.26 | 4.29 | 23.5 | 19.1 | 3.46 |

Rentokil Initial plc Rentokil Initial plc |

Industrials | 0.74182 | 13.83 | 10.52 | 148.39 | 43.97 | 2.13 |

Wynn Macau, Limited Wynn Macau, Limited |

Consumer Cyclical | 0.43146 | -2.07 | 1.35 | 28 | -32.88 | 1.99 |

| 49.56 | 2.88 | 2.62 | 21.57 | 11.04 | 3.04 |

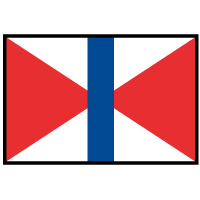

VanEck Morningstar International Moat ETF

Rentabilidad a seis meses: 3.05%

Industria: Foreign Large Cap Equities

Paga tu suscripción

Más funciones y datos para el análisis de empresas y carteras están disponibles mediante suscripción